In the past 4 to 5 years it has been pretty clear in where you should have been buying real estate to maximise your capital growth. Now as we enter 2017 everyone is asking themselves if this growth will continue and should I be buying property today.

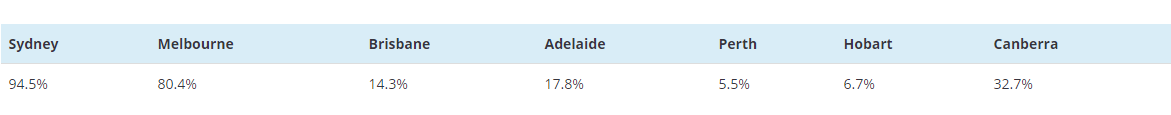

As you can see in the chart below Sydney and Melbourne have led the way in capital growth over the past 4 years. But will this continue as it has in the past? Or is it time to be looking interstate to invest? Many questions surround where you should invest and why you should invest in a particular area. But with our two top capital cities close to doubling what will the outlook be for Sydney and Melbourne.

What we see in Sydney and Melbourne at the moment is the FOMO effect, or fear of missing out as they say. With interest rates at an all-time low and strong infrastructure and jobs growth in these capital cities, there is no wonder why Sydney and Melbourne have ‘boomed’. But as you look closer what you can see is that Sydney and parts of Melbourne are becoming unfordable. With investors dominating these two markets at the present time it is leaving little to the imagination to why investors continue to buy in these capital cities. With the yield at 3-4 %, it is hard to see sense in buying investments in Sydney or Melbourne at this stage.

So what would I buy in 2017? As a buyer’s agent and analyst, I am continually studying the market to see where the next cycle is going to be. If you want to accelerate your portfolio you need to be buying in a ‘recovering market’. Where I see opportunities in 2017 is in QLD as the market is only just surpassing its previous peak in 2009. With strong population growth and infrastructure plans, the southeast Brisbane corridor has a great opportunity for growth over the next 5 years. With yields above 5%, there is no question why investors are keen to move their money out of the Sydney and Melbourne market to access growth along with yield that Brisbane has to offer.

In saying this I do see some areas in Melbourne still performing strongly, these are the areas that are still affordable on the fringes of Melbourne where there is a family demographic and land is in demand. I would typically go for house and land in these particular areas.

I think going forward in 2017 I would be staying clear from units in Melbourne, Brisbane and Sydney as all these markets have had significant growth in the past few years with a lot of supply about to come onto the market, I think it will be a few years until we see the demand meet the supply in this particular market.