It wasn’t that long ago that first home buyers were at their lowest market activity levels in decades.

Strong property price growth in Sydney and Melbourne, in particular, as well as restrictive lending conditions meant they just couldn’t catch a market break.

The thing is, it didn’t take long for their numbers start to swell again, courtesy of softer market as well as borrowing conditions.

Since 2017, first-timers have made their presence felt in the market and that presence is now more pronounced courtesy of a new government grant.

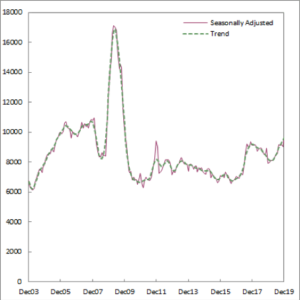

In fact, according to the Australian Bureau of Statistics, the value of loans to first home buyer increased by a staggering 38 per cent over the year to December 2019.

National first home buyer loan volumes

Source: ABS

Affordability battle

The First Home Loan Deposit Scheme came into effect on 1 January and allows first timers to purchase a home with a deposit as low as five per cent.

The scheme works by the government paying the Lenders Mortgage Insurance or LMI on the first home buyers’ behalf.

This is potentially a saving of tens of thousands of dollars.

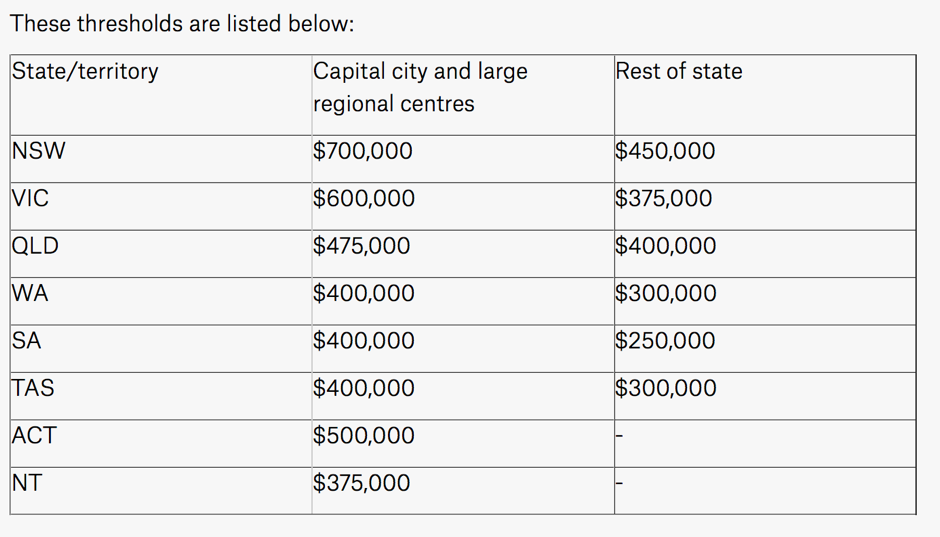

The scheme, like any other, does have certain criteria, including maximum incomes as well as purchase prices.

As you can see, the price thresholds are not overly generous, but generally sit within the affordable price bracket in most property markets.

These brackets are also the domain of investors who, until recently, had little competition for properties.

However, since the start of this year especially, we’re seeing plenty of competition between investors and first home buyers for the same properties.

Something interesting is happening, though.

Whereas sophisticated investors know the price point that a property no longer works in their favour, many first home buyers are paying over the asking price because of a limitation of the scheme.

That limitation is the fact that it is restricted to 10,000 transactions, which is essentially the equivalent of one month of first-home buyer activity on an average month.

While not all prospective property owners qualify for the scheme, it would be a fair assumption to make that the scheme will run out of places very soon – which is why they’re paying more than they probably should in my opinion.

We’re seeing houses in places like Northern Brisbane for under $500,000 being snapped up by first home buyers, with the same happening in Geelong for houses priced under $600,000.

What does it all mean?

There is no denying that property markets are rising in many locations across the country.

The number of loans to owner occupiers is up about 18 per cent over the year to December, and up about five per cent to investors over the same period as well.

With first home buyers now in the mix, too, it appears that we have all buyer types active at the same time.

Of course, it doesn’t take a genius to work out that with ample buyers, and with building approvals still low, there is more demand than supply in many locations.

While it’s too early to say what will happen next, my money is on further price growth in most locations and especially within affordable property price points.

I, for one, am not going to miss the upswing.

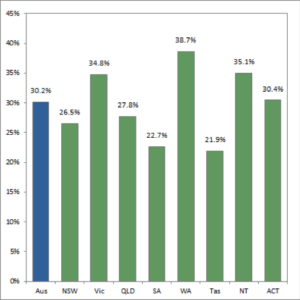

Percentage of first home buyer loans in each state or territory

Source: ABS