Back in March 2019, most people were concentrating on the outcome of the Federal Election here in Australia.

Different housing policies by the two major parties had plenty of investors nervous – and the property market bore the brunt of that temporary unease.

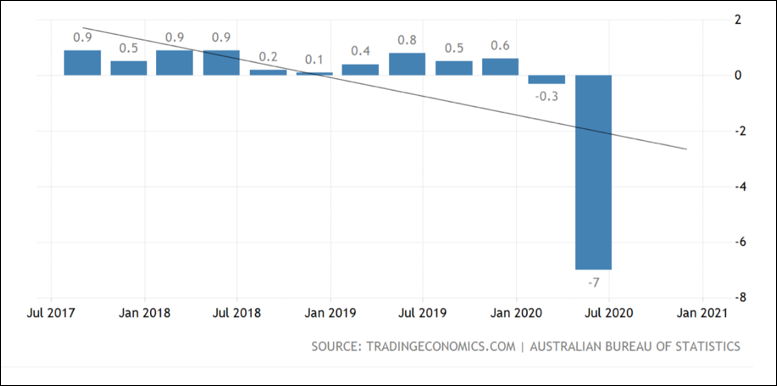

But, at the same time, the national economy was in no great shape either.

In fact, more than 18 months ago, I forecast that the cash rate would hit zero or close to it in the next few years – and here we are!

Of course, no one knew that a global pandemic was about to hit, but our economy was already struggling because of stubbornly low inflation.

GDP had also been underwhelming for six months by then, with no prospect of any great improvement anytime soon.

Here is part of what I said last year: (https://www.yourpropertyyourwealth.com.au/why-i-think-the-cash-rate-will-hit-zero/)

“Most economists are predicting that rates will reduce at some point this year, because of our relatively flat economy.

“However, going out somewhat on a limb here, I believe the cash rate will hit zero in the next few years.

“The reason why I think zero, or very close to, is that inflation is so low that the Reserve Bank needs to motivate people to spend more money.”

Zero in everything but name

It might seem like I had a crystal ball at the time, but my forecast was simply due to my thorough understanding of our economy and the levers available to pull it out of the doldrums.

The pandemic added an urgency to what was likely to happen anyway in my opinion with the Reserve Bank dropping the cash rate again in early November to just 0.1 per cent which, let’s face it, is zero in every sense but name.

Not only did the central bank drop the rate again, but it also announced a number of quantitative easing measures to stimulate the economy and drive jobs growth.

The two main stimulus elements it announced were:

- A reduction in the interest rate on Exchange Settlement balances to zero from the current 10 basis points.

- The introduction of a program of government bond purchases. In particular, we are intending to buy $100 billion of government bonds over the next six months, purchasing bonds issued by the Australian Government as well as by the states and territories.

Impact on property buyers

The cash rate is the lowest it has ever been, and home loans are available with interest rates as low as 1.99 per cent for some borrowers.

Of course, this means that money has never been cheaper for homebuyers and investors, but caution is still advised.

The last thing anyone should do is use the low rate environment to borrow more funds than they can afford to repay when interest rates eventually do rise.

The Reserve has said that the cash rate won’t increase until inflation is comfortably within its two to three per cent target band, which won’t be for a few years.

However, lenders can, and do, increase their interest rates out of cycle, which may catch out borrowers who have over committed themselves financially.

The super low interest rates will put more money in the back pockets of investors, which will help with cash flow as well as their financial buffers.

It will also help to pay down loans for investors who are opting for principal and interest repayments.

Reducing the principal loan amount helps to increase equity, which can be recycled into property investment.

Historically low interest rates are likely to supercharge property price growth over the short- to medium-term, which is a situation that the Reserve has made peace with if it stimulates our economy.

Right now, savvy investors are making the most of the current situation by investing in strategically located properties that are offering plenty of upside potential – as well as benefiting from the cheapest money we’re likely to ever see.