The recent interest rate cut by the Reserve Bank was the first in nearly three years – and it won’t be the last.

Following the announcement, lenders moved quite quickly to pass on the rate reduction to borrowers, with some passing on the full amount and others not quite.

That said, some lenders moved to reduce rates on investment loans, including interest-only, by 35 basis points, which is welcome news given investors bore the brunt of APRA’s lending restrictions over recent years by paying higher interest rates.

Back in April, I predicted that the cash rate would eventually hit zero.

It seemed a bold assumption at the time, but now perhaps not so much.

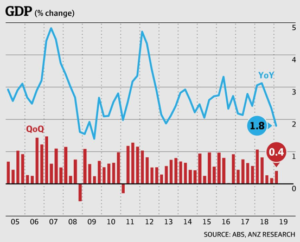

In fact, new data has found that the economy growing at the slowest rate since the middle of the GFC.

Official figures show that the economy grew by 1.8 per cent in the year to March – down from 2.3 per cent in the year to December.

That result, as well as benign wages growth, means that there are more interest rates cut on the way.

I believe there will be another two rate cuts this year, with the first one possibly being as early as July or August.

Two more rate cuts would mean a cash rate of just 0.75 per cent.

The Reserve is clearly trying to kickstart the economy, with rate cuts generally putting more money back into the economy via increased consumer spending.

The rate cut reductions will also underpin property markets, which were hit with a triple whammy of a possible change of government, tight lending and low buyer confidence at the start of this year.

Economic stimulus aplenty

The thing is, more needs to be done to stimulate our economy, with a number of initiatives already under way.

The first one is a tax cut for most Australians from 1 July, as was announced in this year’s Federal Budget.

The tax cut would give back up to $1080 to low- and middle-income earners, which it is hoped they will spend to spur on the economy.

Of course, the property sector is a vital cog in the economy, which is part of the reason for the First Home Loan Deposit Scheme, which will help more first-time buyers into the market.

While first property buyers may only make up about 20 per cent of the sales market, without them vendors can’t sell to upgrade or downsize their own properties, which creates downward pressure on markets.

A healthy property market results in more stamp duty to fund State Governments (regardless of whether you agree with this tax or not) as well as more taxation revenue via Capital Gains Tax payments for the Federal Government.

Clearly, it is hoped that all these factors will jumpstart our economy out of a deflationary state, because that is where it currently is with inflation stubbornly outside of the Reserve’s target band for more than three years now.

While no one wants sky-high inflation, some upward pressure on prices will be the first signal that our economy is moving away from the red and back into the black.

And that is always a better place to be.