At the start of every year, we always receive a flurry of enquiries from potential clients keen to invest this year. Amongst those enquiries are always a cohort of people who want to “get rich quick” supposedly using property as the wealth creation vehicle.

It doesn’t take Einstein to realise that they never engage our services. That’s because our business has always been about creating real estate wealth over the medium- to long-term. We know the value of a long-term property investment strategy.

Often, they get annoyed when we try to educate them about the realities of successful real estate investment – specifically that it takes time for properties to grow in value and for wealth to be created.

We tell them that even when investing in locations with strong market fundaments now and into the future, it is unlikely that anyone is going to become a property millionaire inside a decade.

Short-term investment thinking

Many of these people are fixated on what the media is saying certain markets are doing right now.

They falsely believe that if they buy any old property in a location that may have produced solid growth over recent years, then the money train is on its way.

Little do they know, literally, that the train has already past their station and they didn’t jump on board soon enough to ride the capital growth journey.

It is common in real estate for some people to have short-term investment mindsets. Smart investors realise that a long term property investment is often the most successful.

Unfortunately, with such a point of view, these people often speculate in risky markets, hoping that the returns will keep flowing forever and a day.

What often happens is they’re left with a property that has fallen in value, as well as one they can’t rent out either.

Over history, this has happened plenty of times, and especially in one-industry locations such as mining towns.

About a decade ago, the resources sector was booming, and property prices in those locations were, too, albeit temporarily.

Speculative property investors piled into regions that were heavily reliant on the mining industry – today they are paying the price for their poor decision-making.

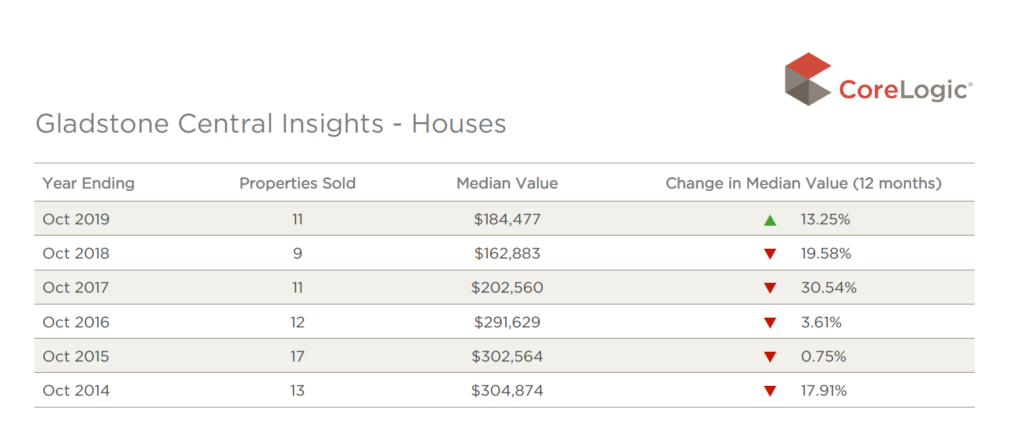

Consider Gladstone in Queensland where median house prices have fallen over 30 per cent over the past five years.

Gladstone change in median value

Some suburbs have seen prices plunge even further, with Calliope recording a massive price drop of 42 per cent and West Gladstone down 43.7 per cent over the same period.

On top of that, about four years ago, residential vacancy rates in Gladstone hit an eye-watering 9.9 per cent.

So, those investors who were enticed by unrealistic future house price growth were soon left wondering where it all went wrong – and often in terrible financial shape indeed.

Long-term property investment is better for tomorrow

Smart investors, on the other hand, bought in locations that had sound fundamentals that would continue to underpin their property markets in the future.

Today, their portfolios have increased equity as well as the potential for passive income in the near future.

They understood that real estate investment is never about making a stab in the dark and hoping for the best.

They worked with experts and over time invested in the best locations for the future.

One thing that they also always did was adopt of a long-term mindset, which meant they paid little notice of the short-term vagaries of market conditions.

Even when prices temporarily flat-lined or softened, they weren’t worried, because they understood the most important thing was the end result – not what happened one or two years amongst decades of property ownership.

A case in point is Sydney and Melbourne, where prices softened for a time recently, but rebounded by the end of last year to both post 5.3 per cent median dwelling value growth.

I guess the point I’m trying to make is that superior investment locations will always have temporary ups and downs.

One thing that never changes, however, are their market and economic fundamentals, which will underpin property price performance over the many years ahead.